How to Upload National Estimatir Into My Quickbooks

HMRC Self Assessment made easy with QuickBooks

Get fix for the HMRC Self-Assessment deadline

Self Assessment? Nosotros got you lot. Take the stress out of tax fourth dimension and have the confidence your taxes are done right with QuickBooks Self Employed.

Prepare your Self Cess taxation render with conviction

Be confident most how much income tax y'all owe – all year round. QuickBooks will auto-calculate your figures and sort your expenses into categories.

Take the guesswork out

QuickBooks Self-Employed will calculate and prepare your Self Assessment using the invoices & expenses you've added. Track your income, expenses and mileage and add together them to QuickBooks Cocky-Employed in one go and from anywhere thanks to our top-rated, free, mobile app. You'll be set to file your render to HMRC with confidence.

Maximise your tax savings

Confidently claim every allowable expense for Cocky Cess. Nosotros'll practice the calculations. Wondering what expenses you lot tin can claim every bit a sole trader? Our online guides volition prepare you straight - without the jargon.

Know what you lot owe

Rail your Income Tax and National Insurance in real-fourth dimension to avoid any nasty surprises. Get a real-fourth dimension view of transactions, invoices, expenses and taxes. Stay in control so y'all know how much you're making and what yous owe. Existent-time banking concern feeds cut hours of data entry.

Talk to a existent person

Our laurels-winning UK-based experts are here for you, seven days a calendar week with gratuitous live chat. If you lot demand virtual help, ask the QB Assistant in our app questions similar 'How much did I earn last year?', 'What tax practise I owe?' or practical questions similar 'How practice I upload a receipt?'

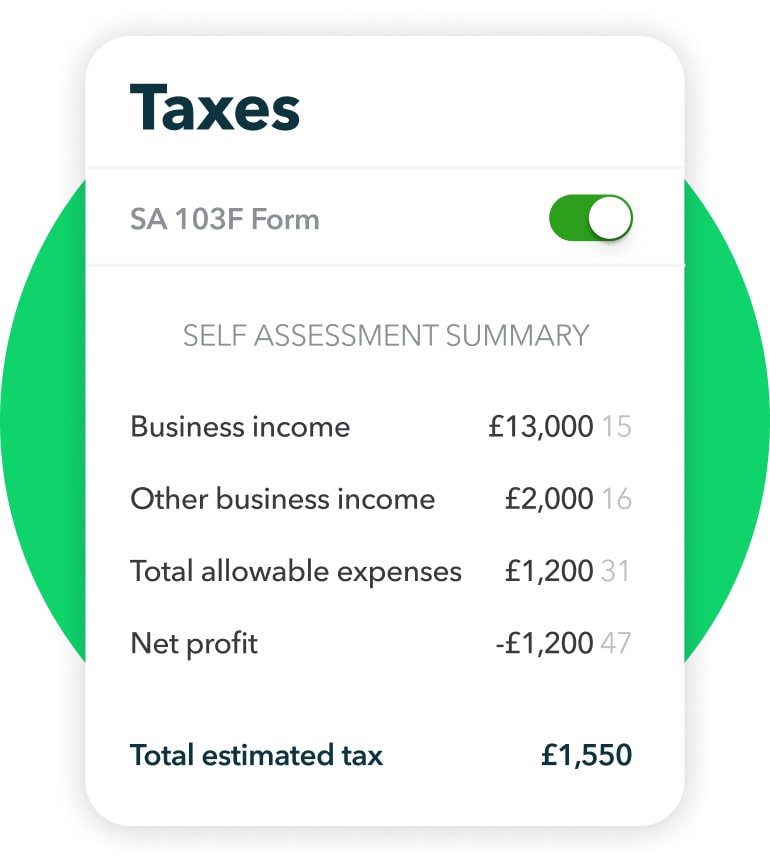

Use reports to see where you stand

Add your tax profile and we'll calculate your taxation summary in an easy report that matches your SA103 (curt) form. Y'all can print off the form from QuickBooks Cocky-Employed to use online with HMRC.

Frequently asked questions

App shop customers love QuickBooks Self-Employed

" This app is great! Paid for itself ten times over already. "

App Store review

" This has saved me and then much time, information technology'due south like having an accountant in my pocket! "

App Store review

" Makes uncomplicated self employed accounting really easy. "

App Store review

QuickBooks Making Taxation Digital for VAT software is available to all QuickBooks Uncomplicated Outset, Essential and Plus subscribers. Use of QuickBooks MTD for VAT software and bridging software must be aligned with HMRC'south eligibility requirements and includes boosted set up between the small concern and HMRC.

QuickBooks MTD software currently supports Standard, Cash and Apartment Rate schemes. QuickBooks Bridging Software supports Standard and Greenbacks schemes. Businesses whose dwelling house currency is not GBP are currently non supported.

Receive a 75 % disbelieve off the current monthly cost for QuickBooks Online Uncomplicated Start or 75 % disbelieve off the current monthly price for QuickBooks Online Essentials or 75 % discount off the current monthly price for QuickBooks Online Plus for the first 6 months of service, starting from engagement of enrolment, followed past the then current monthly toll. Your account will automatically be charged on a monthly basis until you cancel. You must select the Purchase At present option and will non receive a one month trial. Offer valid for new QuickBooks Online customers only. No limit on the number of subscriptions ordered. Yous can cancel at whatsoever time by calling 0808 168 9533. Discount cannot be combined with any other QuickBooks Online offers. Terms, conditions, features, pricing, service and support are subject field to change without notice. All prices shown exclude VAT.

Receive a 75 % discount off the current monthly subscription price for the first half dozen months of service starting from the appointment yous subscribe for the service. In guild to obtain the discount you demand to select the Buy Now option and will not receive the free one calendar month trial offer. After the first half dozen months, your account volition be charged on a monthly basis at the then electric current price until you lot cancel. The above discount offer is available only to new QuickBooks Self-Employed customers and cannot be combined with whatever other QuickBooks Online offers.

Receive 75 % off the current monthly subscription toll for QuickBooks Standard or QuickBooks Avant-garde Payroll for the get-go 6 months of service, starting from the date of enrollment, followed by the then monthly price. Your account volition automatically be charged on a monthly footing for the subscription fee and for all pay runs processed in the previous month, until yous cancel. Yous must select the Buy Now option and will not receive a i month trial. Offering valid for new QuickBooks Online customers only. No limit on the number of subscriptions ordered. Y'all can cancel at whatsoever time by calling 0808 168 9533. Disbelieve cannot be combined with any other QuickBooks Online offers. Terms, conditions, features, pricing, service and back up are discipline to alter without notice. All prices shown exclude VAT.

75 % discount valid until the 14 April 2022 .

Greater savings over a 6 month period can exist establish past reviewing our promotion price on the website – please visit here for our latest promotion: https://quickbooks.intuit.com/uk/pricing/

QuickBooks Advanced Payroll allows you lot to automatically submit information to the post-obit pension providers: NEST, The Peoples Alimony, Smart Pensions, Aviva and Now:Pensions

Gratis onboarding sessions are offered to all newly subscribed customers and trialists, excluding customers on our QuickBooks Self-Employed product. Nosotros offering 1 session per client and reserve the correct to remove this offering at anytime. Invitations are sent via email and in product messaging once sign upwardly has been completed. A link will be included in the messaging for you to book in a session using our calendar tool.

Mileage tracking is bachelor on QuickBooks Self-Employed and QuickBooks Online on iOS and Android only.

These terms apply to QuickBooks UK customers only. Bulk-pricing discount offer is valid only if you are signing upward for more than one QuickBooks Online subscription with each order. View terms and conditions for multiple accounts pricing. To inquire further well-nigh the bulk-pricing discount offering, please call 0808 168 9533.

*QuickBooks United kingdom of great britain and northern ireland have temporarily changed our support hours due to the mandated travel and office restrictions. Please see temporary customer back up opening times:

-

QuickBooks Online Phone – Monday to Friday 8am to 7pm.

-

QuickBooks Online Live Messaging – Monday to Friday 8am to 12am, Saturday and Sun 8am to 8pm.

-

QuickBooks Cocky Employed Live Messaging – Monday to Fri 7am to 10pm, Sabbatum and Dominicus 8am to 8pm.

'Salvage effectually eight hours a month' based on respondents new to QuickBooks; Intuit survey June 2016.

Source: https://quickbooks.intuit.com/uk/hmrc-self-assessment/

0 Response to "How to Upload National Estimatir Into My Quickbooks"

Post a Comment